Problem Solving with Root Cause Analysis (RCA) Training Course

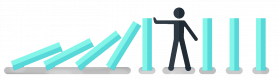

Root Cause Analysis (RCA) is a structured approach to identifying the underlying causes of problems to implement effective solutions and prevent recurrence.

This instructor-led, live training (online or onsite) is aimed at intermediate-level professionals who wish to develop a systematic approach to identifying, analyzing, and resolving problems using RCA methodologies.

By the end of this training, participants will be able to:

- Understand essential concepts of RCA and continuous improvement cycles.

- Apply different RCA tools to identify the root cause of problems.

- Develop and implement effective problem-solving strategies.

- Integrate RCA into organizational improvement and prevention efforts.

Format of the Course

- Interactive lecture and discussion.

- Lots of exercises and practice.

- Hands-on implementation in a live-lab environment.

Course Customization Options

- To request a customized training for this course, please contact us to arrange.

Course Outline

Introduction to Root Cause Analysis (RCA)

- Definition and importance of RCA

- Types of problems RCA can address

- Overview of the continuous improvement cycle

Key Foundations of RCA

- Understanding cause-and-effect relationships

- Common RCA methodologies and frameworks

- Steps in the RCA process

Basic Root Cause Analysis Tools

- 5 Whys Technique: Identifying underlying causes

- Ishikawa (Fishbone) Diagram: Categorizing potential causes

- Pareto Analysis: Prioritizing issues based on impact

Advanced RCA Techniques

- Failure Mode and Effects Analysis (FMEA): Identifying potential failures

- Fault Tree Analysis (FTA): Systematic failure investigation

- Cause and Effect Matrix: Prioritizing solutions based on impact

Applying RCA in Real-World Scenarios

- Case studies and hands-on exercises

- Identifying root causes in business processes

- Developing actionable solutions

Implementing Corrective and Preventive Actions (CAPA)

- Developing corrective action plans

- Establishing preventive measures

- Monitoring and evaluating effectiveness

Prevention and Continuous Improvement

- Proactive problem identification techniques

- Monitoring and sustaining improvements

- Embedding RCA into organizational culture

Summary and Next Steps

Requirements

- Basic understanding of business processes

- Experience with problem-solving or decision-making in an organizational setting

Audience

- Business professionals

- Quality assurance teams

- Project managers and process improvement specialists

Open Training Courses require 5+ participants.

Problem Solving with Root Cause Analysis (RCA) Training Course - Booking

Problem Solving with Root Cause Analysis (RCA) Training Course - Enquiry

Testimonials (4)

examples taken from real life, digressions, exercises were useful plus the opportunity to ask questions at every stage

Karolina - Amer Sports Poland

Course - Governance, Risk Management & Compliance (GRC) Fundamentals

Machine Translated

amount of information and pace

Konrad Przezdziek - Allegro.pl Sp. z o.o., ul. Grunwaldzka 182, 60-166 Poznan

Course - Supply Quality Management

Machine Translated

Trainer has extensive Knowledge and would benefit anyone to get training from such qualified People.

DURGA KODALI - Strata Manufacturing

Course - Advanced Product Quality Planning (APQP)

Hakan was very enthusiastic and knowledgeable

Hugo Perez - DENS Solutions

Course - Project Risk Management

Provisional Courses

Related Courses

Advanced Product Quality Planning (APQP)

28 HoursThe Advanced Product Quality Planning (APQP) course is designed to provide participants with a comprehensive understanding of the APQP process and its application in product development and launch. This course will cover the key concepts, tools, and techniques used in APQP, enabling participants to effectively plan and manage quality throughout the product development lifecycle. Through practical examples, case studies, and interactive exercises, participants will develop the skills and knowledge necessary to successfully implement APQP in their organizations and ensure the delivery of high-quality products to customers.

CMQ/OE and ASQ Certification Preparation

21 HoursThis instructor-led, live training in Poland (online or onsite) is aimed at intermediate-level quality managers and healthcare administrators who wish to learn the key concepts, tools, and techniques essential for quality auditing in healthcare, pass the certification exams, and apply quality management principles in their organizations.

By the end of this training, participants will be able to:

- Understand the principles and practices of quality auditing in healthcare.

- Develop and implement effective quality management systems.

- Conduct comprehensive audits and analyze audit data.

- Prepare for and pass the CMQ/OE and ASQ certification exams.

- Apply ethical principles and regulatory requirements in quality auditing.

Fixed Asset Management and Compliance

14 HoursThis instructor-led, live training in Poland (online or onsite) is aimed at intermediate-level to advanced-level finance and asset management professionals who wish to optimize asset tracking, control, and compliance with international financial reporting standards (IFRS).

By the end of this training, participants will be able to:

- Classify and configure fixed assets according to IFRS regulations.

- Manage asset creation, acquisition, and capitalization.

- Implement control measures for asset tracking and monitoring.

- Apply appropriate depreciation and amortization methods.

- Process asset movements, transfers, and disposals effectively.

- Ensure compliance with financial reporting and audit standards.

Fixed Assets Management and Control

14 HoursThis instructor-led, live training in Poland (online or onsite) is aimed at intermediate-level finance and accounting professionals who wish to effectively manage, value, and audit fixed assets in compliance with accounting standards and regulations.

By the end of this training, participants will be able to:

- Understand the life cycle and classification of fixed assets.

- Apply local and international accounting standards in asset valuation and depreciation.

- Manage fixed assets with proper controls, tools, and procedures.

- Comply with legal and tax frameworks relevant to asset management and reporting.

Governance, Risk Management & Compliance (GRC) Fundamentals

21 HoursCourse goal:

To ensure that an individual has the core understanding of GRC processes and capabilities, and the skills to integrate governance, performance management, risk management, internal control, and compliance activities.

Overview:

- GRC Basic terms and definitions

- Principles of GRC

- Core components, practices and activities

- Relationship of GRC to other disciplines

IATF 16949 - Specialist for Quality Management System (QMS) according to IATF 16949

28 HoursThis comprehensive course is designed to provide participants with in-depth knowledge and expertise in implementing and maintaining a Quality Management System (QMS) compliant with the IATF 16949 standard. Participants will gain a deep understanding of the requirements, processes, and best practices related to automotive quality management. Through practical examples and case studies, participants will learn how to effectively apply the principles of IATF 16949 to ensure the highest level of quality in automotive manufacturing and supply chain operations

Integrated Risk & Corporate Governance

35 HoursOverview

Across the globe regulators are increasingly linking the amount of risk taken by a bank to the amount of capital it is required to hold and banks and financial services are increasingly being managed on risk-based management practices. The banks, their products, the regulations and the global market are becoming increasingly complex, driving ever greater challenges in effective risk management. A key lesson of the banking crisis of the last five years is that risks are highly integrated and to manage them efficiently banks have to understand these interactions.

Key features include:

- the explanation of the current risk-based regulations

- detailed review of the major risks faced by banks

- industry best practices for adopting an enterprise approach to integrating risk management across an entire organisation

- using governance techniques to build a group wide culture to ensure everyone takes an active role in managing risks in line with the banks strategic objectives

- what challenges could be faced by risk managers in the future.

The course will make extensive use of case studies designed to explore, examine and reinforce the concepts and ideas covered over the five days. Historical events at banks will be used throughout the course to highlight how they have failed to manage their risks and actions that could have been taken to prevent loss.

Objectives

The objective of this course is to help bank management deliver an appropriate integrated strategy for managing the complex and changing risks and regulations in today’s international banking environment. Specifically this course aims to give senior level management an understanding of:

- major risk within the financial industry and the major international risk regulations

- how to manage a bank’s assets and liabilities whilst maximising return

- the interaction between risk types and how banks use an integrated approach for their management

- corporate governance and the best practice approaches to managing the diverse interests of the stakeholders

- how to develop a culture of risk governance as a tool for minimising unnecessary risk taking

Who should attend this seminar

This course is intended those who are new to integrated risk management, senior management responsible strategic risk management, or those who wish to further their understanding of enterprise risk management. It will be of use to:

- Board level bank management

- Senior managers

- Senior risk managers and analysts

- Senior directors and risk managers responsible for strategic risk management

- Internal auditors

- Regulatory and compliance personnel

- Treasury professionals

- Asset and liability managers and analysts

- Regulators and supervisory professionals

- Suppliers and consultants to banks and the risk management industry

- Corporate governance and risk governance managers.

Project Risk Management

7 HoursThis course is aimed at Project Managers and those interested in Risk Management within Projects.

Root Cause Analysis (RCA) for Internal Auditors

14 HoursThis instructor-led, live training in Poland (online or onsite) is aimed at intermediate-level internal auditors who wish to enhance their audit effectiveness by applying structured RCA techniques.

By the end of this training, participants will be able to:

- Understand RCA methodologies and their role in internal auditing.

- Identify and analyze the root causes of audit findings.

- Apply RCA tools such as the 5 Whys, Fishbone Diagram, and Failure Mode and Effects Analysis (FMEA).

- Develop corrective and preventive action plans based on RCA findings.

- Integrate RCA into the internal audit process to improve risk management.

Risk Identification and Management Basics

7 HoursCourse Objectives:

- This will be a one-day course and after the activity the trainees/participants will be able to:

- Define what is a risk, its origin and impact on the business as manifested by their increase awareness on the topic.

- Cite different instances that will be helpful for the organization to limit and, ideally eliminate risk.

- Perform proper forecasting of risk and challenges in a proactive manner.

- Discover numerous techniques to identify, mitigate and limit risk.

- Collaborate with internal channels to strengthen risk management for the organization as a whole.

Risk management

14 HoursThe training allows you to learn in practice aspects of risk management in projects. As part of the training participants learn about international standards-based procedures, techniques and tools used in many organizations that allow them to plan the management of challenges in projects, classify them and prepare to consciously manage situations with low predictability and crisis situations.

The training is dedicated to those interested in developing competence in risk management - one of the main elements of conscious management of Project Managers, Scrum Masters.

The training consists of a substantive part, workshops, practical examples.

Supply Quality Management

14 HoursThis instructor-led, live training in Poland (online or onsite) is aimed at supply managers and personnel who wish to adopt a quality-centric approach to managing suppliers.

By the end of this training, participants will be able to:

- Adopt a proactive and collaborative approach for enhancing supplier quality.

- Clearly define and communicate supply specifications and requirements.

- Explore different Supplier Quality Management Systems (QMS) and apply an analytical approach to choose the most suitable one.

- Use a QMS system to continuously monitor, inspect and audit supply chains.

- Ensure that suppliers provide the highest quality products and services.

Statistical Process Control (SPC)

14 HoursThis instructor-led, live training in Poland (online or onsite) is aimed at beginner-level quality control professionals who wish to learn the fundamentals of Statistical Process Control (SPC) and apply it in real-world scenarios.

By the end of this training, participants will be able to:

- Understand the fundamentals of Statistical Process Control (SPC).

- Use basic SPC tools such as control charts, histograms, Pareto charts, and scatter diagrams to monitor process performance.

- Create and interpret various types of control charts for variable and attribute data to detect and analyze process variations.

- Calculate and interpret process capability indices.